Between the pre-seed and seed rounds for Griffin we pitched nearly 200 different investors. These are some of their reasons for saying no.

- It's too early[1]

- *sound of investor ghosting*

- Brexit

- The market is too small

- The market is huge, but only if you expand to the US, which we don't think you can do

- The market is huge and has experienced massive growth but we feel there is no more growth to be had

- The market has long-term commodity pricing dynamics so there is no profit to be made here

- Your customers are too small and not enough of them will grow beyond that

- You won't get a bank license

- Your team doesn't have enough people with banking experience

- We think the product is too simple

- We think you will not be able to build a product

- It will take you too long to build a product

- We see strategic value here, we just want to wait until we can engage commercially [from a strategic investor]

- We see strategic value here and we think this would be a good investment, but we're only investing in AI and blockchain companies right now [from a strategic investor]

- You're not raising enough capital now - you need way more

- You're raising too much capital now - you should try to do a smaller version of what you're doing

- You will have to raise a lot of capital in the future and we're not sure you will be able to

- You will have to raise a lot of capital in the future and that will dilute our ownership stake

- We're not comfortable investing unless you as founders invest £[more money than we have]

- It has taken you too long to raise this money

- What are you talking to us for? You should raise with an ICO!

- We're too small of a fund for this

- We're too big of a fund for this

- [vague excuse to cover for the fact that they are in between funds]

- [honest statement that they are in between funds]

- We only invest after revenue/product-market fit (from a seed fund)

- You don't know how to sell this

- We like to see an "explosive" sales pipeline

- We don't invest [in the UK / in the EU / outside of the US]

- We don't invest in firms that aren't EIS eligible out of preference

- We don't invest in firms that aren't EIS eligible out of legal requirement

- You have too many competitors

- The biggest firms in your space aren't doing this, therefore it's not worth doing

- These businesses aren't fundable

- Your competitors are too well-funded

- We don't understand what differentiates you from your competitors

- Your competitors are executing badly now but they will start to execute better in the future

- [summary of efficient markets hypothesis][2]

- "The solution is somewhat derivative"

- You don't have a competitive moat

- We have a competitive investment in [competitor]

- We have a competitive investment in [not a competitor]

- We don't have the expertise to evaluate you

- This is out of scope for us [from a fintech fund]

- We don't have conviction about what the future of this space is

Honorable mentions: unreasonable conditions

- We'll only consider investing if you can bring a second institutional investor to the table

- We'll only invest if [a major strategic firm] takes a stake

- [once we actually had a term sheet] We'll invest if you let us invest on the terms of your last round

- [once we actually had a term sheet] We'll invest a very small check if you give us a 40% discount and a board seat

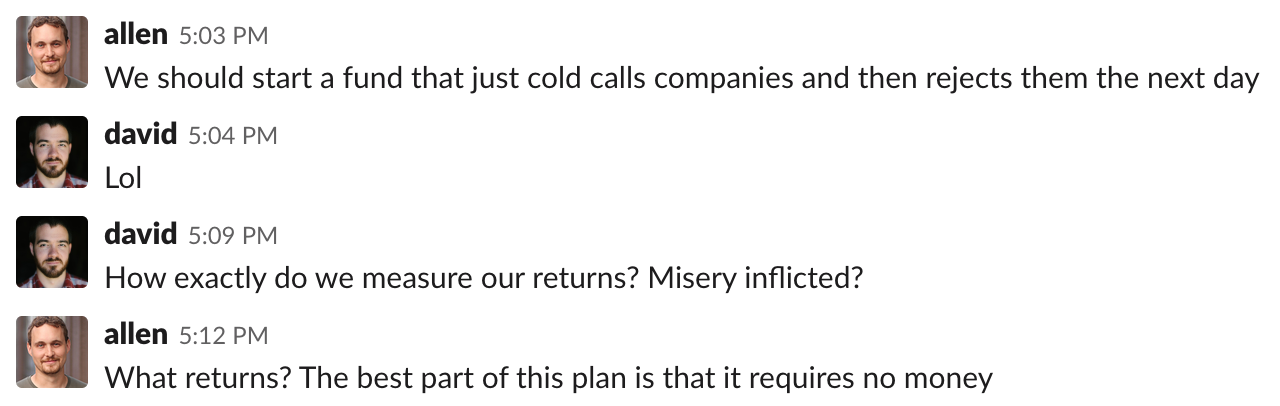

And a recommendation for aspirational VCs reading this:

[1]: This catch-all excuse could mean anything from "we don't invest at seed" to "we're busy watching Game of Thrones"

[2]: This was from a partner at a £500M VC fund